November 1, 2012

Mining and Exploration Activities in Eritrea

by Yishak Yaried | A number of important milestones were achieved in the mineral sector in Eritrea since the last publication of this journal.

by Yishak Yaried | A number of important milestones were achieved in the mineral sector in Eritrea since the last publication of this journal.

These include among others the signing of Mining Agreements for the Koka gold and the Harena deposits, the completion of a Feasibility Study for the Debarwa deposit and Pre-feasibility Study for the Asmara north projects of Sunridge Gold, the completion of Scoping and kick off of Definitive Feasibility Study for the Colluli potash, target generation and detail follow ups at Haykota, Adobha and Akordat North concessions.

There are now twenty exploration and mining companies operating in Eritrea and represent Canada, Australia, China, UK, UAE and Barbados. One of them is an operating mine while another one has finished most regulatory requirements to start development work. Two more companies are following suit by completing feasibility studies soon. Total surface area covered is a little over 17.5 thousand sq.km. from which the mining license area is 41 sq.km.

Mining and Development-Stage Companies

Bisha Mining Share Co (BMSC) is a mining company formed by a joint venture agreement between Eritrea’s National Mining Corp. (ENAMCO) and Canada’s Nevsun Resources Ltd. BMSC managed to successfully start and operate the first modern mine in Eritrea. Bisha mine was commissioned in the end of 2010 and commercial production started in February 2011. Since then mining continues with strong operational and safety performance. Bisha is a high grade, low cost mine with 28 million tons @ 1.78 g/t gold, 38.9 g/t silver, 1.6% copper and 3.15 % zinc and indicated and inferred resource of 10.6 million tons @ 0.67 g/t Au, 47.78 g/t Ag, 0.91 percent Cu and 5.67 percent Zn consisting three layers of mineralization, the oxide, supergene and primary zones.

After operating the mine for over a year and half BMSC has recently announced a new reserve totaling 26.5 million tonnes for a total of 167,000 troy ounces of gold, 1.041 billion pounds of copper, and 2,680 million pounds of zinc. As indicated above the gold reserve in the oxide cap will last only for few months. The addition of the Harena gold, for which a mining permit has recently been issued by the MoEM, will extend the life of the current gold recovery operation until the expected commissioning of the copper plant in mid 2013. Copper production is expected to be 180 million pounds of payable metal per year, in concentrate with significant gold and silver byproduct credits. The concentrate will be shipped using the existing Massawa container port.

After operating the mine for over a year and half BMSC has recently announced a new reserve totaling 26.5 million tonnes for a total of 167,000 troy ounces of gold, 1.041 billion pounds of copper, and 2,680 million pounds of zinc. As indicated above the gold reserve in the oxide cap will last only for few months. The addition of the Harena gold, for which a mining permit has recently been issued by the MoEM, will extend the life of the current gold recovery operation until the expected commissioning of the copper plant in mid 2013. Copper production is expected to be 180 million pounds of payable metal per year, in concentrate with significant gold and silver byproduct credits. The concentrate will be shipped using the existing Massawa container port.

In addition to the Harena mine, resource expansion opportunities include the Bisha main inferred resource, the near surface hanging wall copper and the Northwest deposit. Exploratory drilling has been carried out to better determine the extent of these resources.

Zara Mining Share Company (ZMSC) is joint-venture between ENAMCO and Chalice Gold Mines an Australian exploration company. ZMSC owns the high grade, Koka gold deposit and a substantial, largely unexplored, land package to the north and south of this deposit. The Koka deposit is estimated to host around five-million tons of ore, grading at 5.3 g/t gold, for 840 000 contained ounces.

The deposit further hosts a probable ore reserve of 4.6- million tons, at 5.1 g/t gold for the 760 000 contained ounces. The Company is focused on developing the Koka Gold Deposit into a low cost open-pit gold mine which is expected to produce 104,000 ounces of gold per year over a 7 year mine life at an average cash cost of US$ 338/oz gold.

A mining agreement has been signed with the MoEM in January. The SEIA and SEMP documents have been thoroughly reviewed by various stakeholders. The Department of Environment, Ministry of Land, Water and Environment has recommended conditional clearance to ZMSC in June and the MoEM is considering approving to start development works, which is expected to start in October.

In addition to this, Chalice, through its wholly owned subsidiary Sub-Sahara Resources (Eritrea) Ltd., holds exploration licenses at Hurum (275sq.km.), immediately southeast of ZMSC’s Zara licenses and at Mogoraib (550 sq.km.), north of Bisha VMS mine. ENAMCO has acquired 40% interest of these licenses. In Mogoraib, based on the Versatile Time-domain Electro-Magnetic (VTEM) survey and regional and detailed geological mapping and ground gravity geophysical surveys a 5000m diamond drilling program of the basement conductors has started. In Hurum, stream sediment sampling has identified an area of highly anomalous gold values in the north of the property.

Sub-Sahara was active in Eritrea in the past twelve years and remembered as a company who has promoted the Debarwa to the advanced exploration and discovered and defined the resource of Koka before Sunridge and Chalice took over the properties respectively.

Sunridge Gold Corp.(SGC/TSX) is a Canadian, mineral exploration and development company engaged in exploration and development of base and precious metal deposits partially surrounding Asmara. Hence collectively the project is known as the Asmara project and includes the Medrizien,Adi Nefas and Debarwa concessions. Sunridge has acquired the property from Sub-Sahara Resources in 2003. This area has previously been explored by different companies including Phelps Dodge, Western Australia, La Source Development, Golden Star and Ashanti Gold.

Sunridge Gold Corp.(SGC/TSX) is a Canadian, mineral exploration and development company engaged in exploration and development of base and precious metal deposits partially surrounding Asmara. Hence collectively the project is known as the Asmara project and includes the Medrizien,Adi Nefas and Debarwa concessions. Sunridge has acquired the property from Sub-Sahara Resources in 2003. This area has previously been explored by different companies including Phelps Dodge, Western Australia, La Source Development, Golden Star and Ashanti Gold.

The work thus far done by Sunridge, has resulted in the defi nition of four NI 43-101 compliant resources on the Asmara Project (Debarwa VMS, Embaderho VMS, Adi Nefas VMS and Gupo gold deposits) with total combined metal content of 1.3 billion pounds of copper, 2.5 billion pounds of zinc, 1.1 million ounces of gold and 32 million ounces of silver. The largest deposit is the 63 million ton Emba Derho copper-zincgold VMS deposit that is located just 12 kilometers from Asmara.

The main focus of the company in the past twelve months was to advance these projects to mining. As a result it has produced a pre-feasibility study in May 2012 which considered an integrated mining operation for all four deposits with a central mill located at Emba Derho. Independently a feasibility study was completed for the Debarwa deposit as a standalone mine. The fate of Debarwa will be decided early next year when the Feasibility study for the integrated mining is completed. In line with this environmental studies are going on.

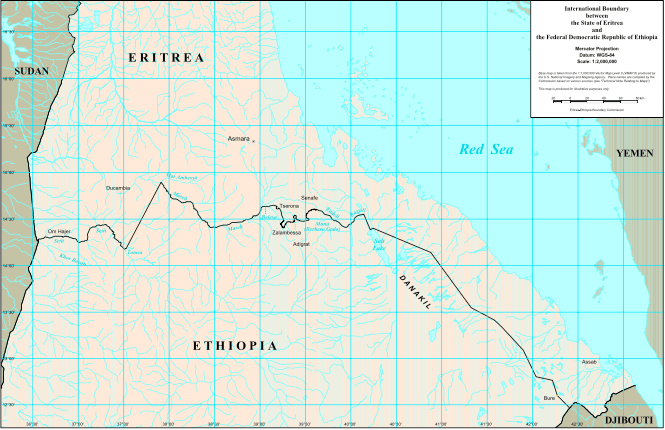

STB Eritrea Pty. Ltd.(STB) is a subsidiary of South Boulder Mines Ltd., a junior Australian exploration company and is successfully promoting the potash resources of Colluli in Danakil area. Fortunately for the company, in a short period of time, it has delineated two independent ore bodies that contain significant amount of potash at shallow depth. A JORC/43-101 compliant resource has been established totaling 1.08Bt @ 18% KCl with total contained potash of 194Mt. An Engineering Scoping Study (ESS) completed in November 2011 considered the production of 1Mt p.a. of potash by open pit mining.

The ESS produced a highly attractive economic result that warranted further study. Relative to the entire potash industry, Colluli Project has the cheapest initial costs and the lowest operating costs. The ESS has considered extraction of the upper Sylvinite layer which is only less than 16% of the potash. Definitive Feasibility Study (DFS), which is expected to be completed in 2013, will consider mining and processing the Carnallite and Kainite layers. Along with the preparation of the DFS, STB together with MoEM are producing the Terms of Reference for the compilation of Social and Environmental Impact Assessment.

NGEx Resources/Sanu Resources Inc. is a Canadian exploration company, remaining with only the Mograib exploration license. The request for extraordinary extension of the Kerkebet license has been rejected by MoEM and Lelit and Shikula properties were relinquished by the company itself.

NGEx Resources/Sanu Resources Inc. is a Canadian exploration company, remaining with only the Mograib exploration license. The request for extraordinary extension of the Kerkebet license has been rejected by MoEM and Lelit and Shikula properties were relinquished by the company itself.

Sanu has flown a VTEM survey over the entire exploration package. The most advanced work was done in the Mograib area where the Hambok deposit was defined. Hambok deposit has an NI43-101-compliant indicated resource (@0.75% zinc cutoff) of 10.7 million tones grading 0.98% copper, 2.25% zinc, 6.84 g/t silver, 0.20g/t gold and an additional inferred resource (@0.75% zinc cutoff) of 17.0 million tones of 0.85% copper, 1.74% zinc, 5.89g/t silver, 0.19 g/t gold.

Initial drilling works in the Aradaib Prospect, in the Kerkebet license reported interesting results such as 13m of 3.3 % copper, 5.6% zinc, 1.8 g/t gold, 46 g/t silver. Recently NGEx Resources, subject to the Ministry’s approval, has decided to sell the Mogoraib project to BMSC for US$5,000,000 and additional cash consideration of US$7,500,000 upon the commencement of commercial production from the Mogoraib Exploration License.

Exploration Companies

Exploration Companies

Andiamo Exploration Ltd. is a junior UK based exploration company that has been actively engaged in regional, as well as detailed geologic mapping, image interpretation, soil sampling and ground gravity surveys in the Haykota area since 2009. In addition a VTEM survey was carried out over the whole 716 km2 exploration license area. Andiamo bought state-of-the-art ground magnetic and IP/Resistivity equipment and has developed an in-house capacity to carry out detailed surveys. Based on the above works it has identified a total of 24 potential VMS target areas including 15 targets for gold exploration. Follow up of several of these target areas including exploratory drilling at five prospects have being carried out. The MoEM has recently approved the first ordinary extension of the license which will allow Andiamo to continue its exploration until July 2013. A preliminary resource assessment is expected for some of the prospects within the extension period.

Beijing Donia Resources Co. is a Chinese exploration company that initially acquired exploration licenses for iron in various parts of Eritrea. The results were not encouraging in terms of tonnage and the metal price and therefore decided to relinquish all iron exploration activity. Since 2007 the company is exploring for gold and base metal resources in Kenatib southern Eritrea. In the past five years of exploration right over this area Bejing Donia has conducted geologic mapping, gravity and IP surveys. Based on results it is planning to carry out test drilling on some of the prospects.

Beijing Donia Resources Co. is a Chinese exploration company that initially acquired exploration licenses for iron in various parts of Eritrea. The results were not encouraging in terms of tonnage and the metal price and therefore decided to relinquish all iron exploration activity. Since 2007 the company is exploring for gold and base metal resources in Kenatib southern Eritrea. In the past five years of exploration right over this area Bejing Donia has conducted geologic mapping, gravity and IP surveys. Based on results it is planning to carry out test drilling on some of the prospects.

Land Energy Group (China) Ltd. Is a Chinese exploration company that is looking for gold and base metal deposits in Gogne area. The area extends from Gogne north to Tekawda, south of Bisha mine. There is high probability to find a Bisha type VMS deposits or prospects like those found in Haykota area. Most of the work so far carried out is limited to sampling and assaying including trench sampling in localized area. However, small but unsuccessful drilling has been carried out in the past.

China Africa Huakan Investment Co. has exploration licenses in Seroa, north of Keren, and Mensura area granted in 2009 and 2011 respectively. A couple of holes have been drilled at Seroa with some encouraging results. Further work will be approved by management based on the results. Mensura was originally a prospecting license which was transferred into exploration after conducting regional works over the whole area. Regional and detail mapping and sampling programs are continuing.

China Africa Huakan Investment Co. has exploration licenses in Seroa, north of Keren, and Mensura area granted in 2009 and 2011 respectively. A couple of holes have been drilled at Seroa with some encouraging results. Further work will be approved by management based on the results. Mensura was originally a prospecting license which was transferred into exploration after conducting regional works over the whole area. Regional and detail mapping and sampling programs are continuing.

Zhong Chang Mining Co. Ltd. is a Chinese company granted exploration license in Mai-Mine area. The Company has been doing geological mapping and grab sampling and trenching to define targets for drilling. High precision magnetic survey over selected targets has been carried out.

London Africa Ltd. is a British private exploration company that has an exploration right over 1,168 km2 area near Akordat which also includes the Orota area. Regional works and VTEM survey over 60% of the area has identified numerous prospects within four mineralized districts defined by the company. A shallow diamond drilling (10 holes, 777m) has been carried out early this year to test main section of the quartz veins in the Taninay gold prospect. Encouraged by the results London Africa is planning to cover the prospect by RC drilling. Further detail follow up programs including sampling, gravity survey and drilling is planned for the other prospects.

London Africa Ltd. is a British private exploration company that has an exploration right over 1,168 km2 area near Akordat which also includes the Orota area. Regional works and VTEM survey over 60% of the area has identified numerous prospects within four mineralized districts defined by the company. A shallow diamond drilling (10 holes, 777m) has been carried out early this year to test main section of the quartz veins in the Taninay gold prospect. Encouraged by the results London Africa is planning to cover the prospect by RC drilling. Further detail follow up programs including sampling, gravity survey and drilling is planned for the other prospects.

Sahar Minerals Ltd. is a privately owned exploration company established and registered in Bermuda in early 2009. In February 2010 it was able to acquire two exploration licenses (Augaro and Harab Suit) in Eritrea.

Sahar took over operation of the Augaro property from Eritrea-China Exploration and Mining Share Company (ECEM) following the JV agreement signed between the two companies. ECEM by itself is a JV company formed by ENAMCO and a Chinese company and was managing exploration works in Augaro since 2007. On the other hand, Harab Suit is a 379 km2 exploration license, located in the NW part of Eritrea close to the Sudan border.

Sahar took over operation of the Augaro property from Eritrea-China Exploration and Mining Share Company (ECEM) following the JV agreement signed between the two companies. ECEM by itself is a JV company formed by ENAMCO and a Chinese company and was managing exploration works in Augaro since 2007. On the other hand, Harab Suit is a 379 km2 exploration license, located in the NW part of Eritrea close to the Sudan border.

Both properties are historically known for gold mining by the Italians and were also subject to recent exploration by various other companies. After reassessing previous works Sahar conducted regional and prospect scale investigation comprising of mapping, sampling and geophysics. So far Sahar has drilled 15,991m RC and 497 DD in Augaro, and 2,060m RC in Harab Suit.

Adobha Resources (Eritrea) Pty Ltd., a wholly owned subsidiary of Gippsland Ltd, is an Australian junior exploration company. It has two contiguous exploration licenses in the Adobha area in northern Eritrea with 2,200km2 combined surface areas. Both licenses were converted from prospecting after a thorough preliminary helicopter assisted reconnaissance surveys were completed. Airborne geophysics over the entire area was carried out using VTEM system. The results from these surveys and subsequent follow up works led the company to initiate a RC drilling program over a selected prospect. The program required Adobha Resources to clear long access road from Zara to mobilize the drill rig to the site.

Adobha Resources (Eritrea) Pty Ltd., a wholly owned subsidiary of Gippsland Ltd, is an Australian junior exploration company. It has two contiguous exploration licenses in the Adobha area in northern Eritrea with 2,200km2 combined surface areas. Both licenses were converted from prospecting after a thorough preliminary helicopter assisted reconnaissance surveys were completed. Airborne geophysics over the entire area was carried out using VTEM system. The results from these surveys and subsequent follow up works led the company to initiate a RC drilling program over a selected prospect. The program required Adobha Resources to clear long access road from Zara to mobilize the drill rig to the site.

Thani-Ashanti Akordat North Ltd. and Thani-Ashanti Kerkasha Ltd. Are two independently registered exploration companies representing the Thani Ashanti of UAE, a recently-formed Strategic Alliance between AngloGold Ashanti and Thani Investments. The area of operation is in the Gash Barka region with partly extension of Akordat North license to the Anseba Region. Making a total of 1863 km2. A 10,000 line km VTEM survey has been completed over both areas in early 2011 and since then the company was actively engaged in follow up sampling. The Akordat North has been covered by extensive stream sediment sampling including the most recently completed helicopter-assisted sampling in the inaccessible NE part of the license. The company was happy the way the Eritrean General Aviation Services has managed to do the work efficiently and safely. Detailed mapping of target areas is planned with the ultimate aim of generating drill targets. In Kerkasha, work delayed because of an assumed security reasons. The Stream Sediment sampling started in April 2012 over two years after the granting of license. However, by late May almost two thirds of the area was sampled.

Beijing Sinoma Mining Investment Ltd is a Chinese exploration company looking for potash deposit in the 455 Km2 exploration in Dengel area immediately west of Colluli. It was granted the license in late 2010 and since then was busy in establishing camp and importing in equipment for drilling. So far 10 holes have been drilled in the area with little intersection of potash mineralization. Gravimetric surveys were initiated to better define the lithological sequences. New arrivals to the industry include Chinese companies such as Shandong Mining Development Ltd., Min Metals Exploration & Mining Ltd., Hubei Geological Mapping and Mining Ltd. (China) and a UAE based Indian company, Bab al Rayan Jewellery PLC. These companies either they are inactive or only limited reconnaissance work has been done to be worth mentioned.

Beijing Sinoma Mining Investment Ltd is a Chinese exploration company looking for potash deposit in the 455 Km2 exploration in Dengel area immediately west of Colluli. It was granted the license in late 2010 and since then was busy in establishing camp and importing in equipment for drilling. So far 10 holes have been drilled in the area with little intersection of potash mineralization. Gravimetric surveys were initiated to better define the lithological sequences. New arrivals to the industry include Chinese companies such as Shandong Mining Development Ltd., Min Metals Exploration & Mining Ltd., Hubei Geological Mapping and Mining Ltd. (China) and a UAE based Indian company, Bab al Rayan Jewellery PLC. These companies either they are inactive or only limited reconnaissance work has been done to be worth mentioned.

Source: Eritrea Mining Journal (October 2012)